The accounts payable(AP) process is indeed the backbone of an organization as it directly impacts cash flow optimization, fraud prevention, and customer relationship. Also, the accounts payable process is specifically challenging due to the high dependency on human and paper-driven methods to complete the process. With rising customer preferences for convenience, high volume data errors, and risk to data threat banking and financial services are realizing the fact that manually driven paper-based process also leads to higher operational costs and missed business opportunities.

That’s the reason, organizations are looking forward to leveraging RPA in the accounts payable process. RPA in the accounts payable process rules out the requirement of employees handling the process and reduces operational costs. Let’s go through this blog and discover how automation in the accounts payable process benefits organizations and streamline overall processes.

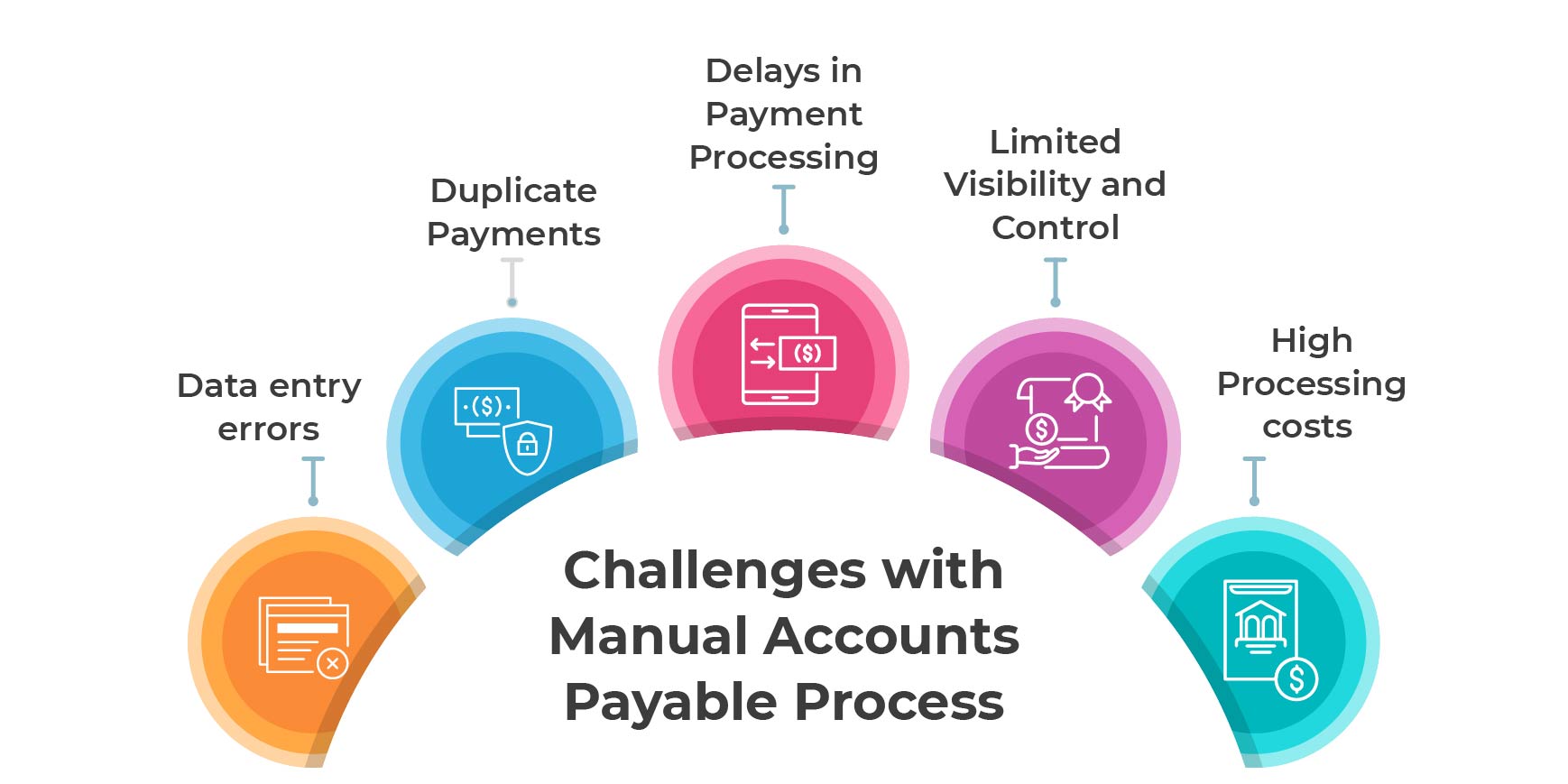

Challenges with Manual Accounts Payable Process

Manual accounts payable processing can be a time-consuming and error-prone process. Here are some challenges that can arise from manual AP processing:

-

Data entry errors

Manual data entry can lead to mistakes, such as typos or transposed numbers, which can cause discrepancies in the accounting records.

-

Duplicate Payments

Without automated systems to detect and prevent duplicate payments, manual accounts payable processing can result in duplicate payments being made, causing unnecessary financial losses.

-

Delays in Payment Processing

The manual accounts payable process can be slow and inefficient, leading to delays in payment processing and supplier payments.

-

Limited Visibility and Control

Manual accounts payable processing may lack transparency and visibility into the status of invoices, payments, and approvals. This can lead to a lack of control and an increased risk of errors.

-

High Processing costs

Due to the time and resources needed to manage manual accounts payable processing, such as manual data entry, manual invoice matching, and manual payment processing, manual AP processing can be expensive. Also, manual accounts increase the risk of compliance and regulatory issues, such as missing tax deductions, late payments, or incorrect financial reporting.

Why RPA in Accounts Payable Process?

Handling invoices in an efficient and intelligent manner is one of the major priorities for finance heads of an organization. Also, the account payable team has to rely on third-party vendors, to capture and extract information and process invoices for payment, There are at least 4-5 stakeholders who are involved in the accounts payable process, hence integration within the organization’s process and cooperation with employees and technology is vital.

However, there are multiple technologies in the market to streamline the accounts payable(AP) process to automate, but what makes RPA the ideal solution to AP automation is the flexibility, ease of use, and high integration of workflow that RPA facilitates. If reports are to be believed, the growth of RPA in financial services is expected to reach $12 billion by 2023. Moreover, automation in finance departments can easily control and automate rule-based processes including collection and deduction management.

Having robots in the repetitive process, RPA enables faster resolution, a low volume of errors, and easy access to the information required to perform the accounts payable process.

How do Accounts Payable Process Automation Work?

Automation in the finance department is indeed a strategic factor to enhance process efficiency and make sure that the finance team is able to focus on tasks that actually require their attention. Leveraging RPA in the accounts payable process can help the finance team get rid of mundane, repetitive processes and enable a better work experience. Let’s go through how accounts payable automation works-

-

Invoice Extraction & Approval

This is the first and most complex step in the accounts payable process that involves managing and juggling a huge pile of email threads and manual efforts to follow up with customers and departments. On top of that, the finance team receives invoices from different routes including email, fax, email portal, pdf, text, and also from vendors that must be approved by finance department heads.

This whole step-by-step process is incredibly tiresome and takes manual efforts to follow up with multiple people across departments. Also, it makes a difficult to locate where are invoices in the approval process in case vendors call in to check the status.

Applying RPA in this step of the accounts payable process enables better management of invoice approval and the PO matching process. RPA in integration with intelligent document processing solutions can extract data from any form of document and process it to the person it is entitled to. Additionally, RPA bots can be used to send reminders on deadlines for invoice approval without any manual intervention. Similarly, automating the purchase order matching using algorithms to quickly compare invoices to their corresponding POs and flag mismatches for further review should be another priority for organizations. -

Data Entry & Matching

This is another challenging step in the accounts payable process where getting all of the invoices data must be coded into the accounting system of organizations accurately. With high volume invoices data it is time-consuming to feed all data in the accounting system error-free and with fewer resources.

By implementing RPA in the data entry process, the finance team can ensure that there are no longer extra resources and time required to feed the data as RPA bots can take care of this, RPA bots can add data autonomously as soon as invoices are approved. As bots are handling this process, the accuracy of data is maintained and the overall process efficiency of the accounts payable process also increased. Furthermore, RPA bots can also perform data match/mismatch and eliminate the risk of fraud and generate alert on time. -

Payment Execution

After entering data into the accounting system, payment execution in the accounts payable process is another step that requires employees’ focus and attention. Once the invoices are authorized by the accounts payable teams, the invoices go to the person who processes them by executing the payment. But before initiating the payment, the concerned employees must have clear visibility into payment due dates. With hundreds of invoices on a monthly basis, keeping track of payment execution and its deadline on a monthly basis is tiresome.

Implementing RPA in this step of the accounts payable process automatically schedules payments and sends them on the given deadline or date. Also accounts payable process automation with RPA bots offers a centralized location for the finance team to choose the payment options. This makes it much simpler to eliminate the fraud risk and reduce the costs that come with every payment.

Is RPA in Accounts Payable Process Must?

Considering the number of benefits RPA in financial services or other industry brings, the accounts payable process can definitely be automated for better data accuracy. With RPA in accounts payable process organizations not only get an assistant that can take care of all repetitive processes but also makes sure that each step and process is done efficiently without any chance of error and risk. Also with end-to-end accounts payable process automation enterprises get a better way to maintain compliance data and improve customer relations.

The post How does RPA in Accounts Payable Enhance Data Accuracy? appeared first on AutomationEdge.

This is a companion discussion topic for the original entry at https://automationedge.com/blogs/how-does-rpa-in-accounts-payable-enhance-data-accuracy/