Table of Contents

- What is RPA in Insurance?

- Challenges in the Insurance Industry

- RPA Use Cases in Insurance

- Benefits of RPA in Insurance

- Why RPA for Insurance Industry?

- Future Scope of RPA in Insurance

- How to Find the Best Software for RPA in Insurance Services?

- How can AutomationEdge Help the Insurance Industry?

- Conclusion

- FAQs

Table of Contents

- What is RPA in Insurance?

- Challenges in the Insurance Industry

- RPA Use Cases in Insurance

- Benefits of RPA in Insurance

- Why RPA for Insurance Industry?

- Future Scope of RPA in Insurance

- How to Find the Best Software for RPA in Insurance Services?

- How can AutomationEdge Help the Insurance Industry?

- Conclusion

- FAQs

What is RPA in Insurance?

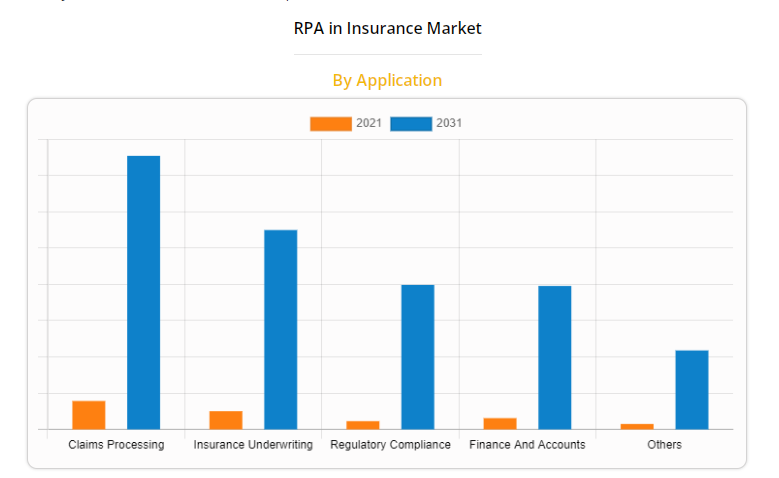

The insurance industry is one of the most heavily burdened, conventional and rigid to changes. However, considering the high customer demand for app-based or digital transactions, the industry players have started transforming their insurance operations using high-end technology tools. This is the reason why 80 % of insurers acknowledge the need for digital capabilities. Yet, 99.6 % of those surveyed found it difficult to implement digital innovation. The insurance industry has the potential to automate nearly 50-60% of the back-office processes by 2025, resulting in 66% time savings. Robotic Process Automation, being one of the highly adopted technology tools across industries, is helping insurance industry players live up to ever-rising customer expectations and provide a top-notch customer experience.

RPA in the insurance industry automates repetitive, mundane human tasks using rule-based, low-code or no-code software bots. These bots swiftly reduce turnaround time in various insurance operations and extract data from various customer documents like claim forms, identification documents, policy documents etc. Overall, RPA helps insurers to drive speed, efficiency and customer satisfaction.

RPA in Insurance Use Cases

-

Claim Processing:

RPA can process claims 75% faster than humans. NLP and OCR extract data and input, claims errors, and verify fraudulent claims. By limiting human intervention in insurance claim processing, RPA reduces multiple touchpoints and accelerates the timely payout with a customer-centric approach.

-

Underwriting Processes:

With AI and Machine Learning, RPA can:

- Fill required data field in the internal system

- Access data from internal & external locations

- Evaluate loss runs

- Analyze the customer’s history and provide pricing options

- Trigger system at-risk and fraudulent cases

This eventually streamlines the underwriting process in the insurance sector so that customers receive decisions quickly and underwriters can free up to handle more complex tasks.

-

Regulatory Compliance:

To standardize the documentation and audit trails, RPA helps insurers by automating:

- Client Research and Customer Data Validation

- Compliance Report Generation

- Data Security Operations

- Account Closure Notification

-

Sales and Distribution:

RPA can simplify the intimidating and rumbling tasks of sales and distribution in insurance. RPA can automate tasks like-

- Legal and credit checks

- Create sales records

- Conducting compliance

RPA helps enterprises in chalking out a workflow that ensures customer satisfaction through timely deliveries.

-

Finance and Accounts:

With high volume data processing, insurers often struggle to provide error-free customer service. RPA bots can easily perform clicks and keystrokes, copy/paste, autofill templates, and generate reports and push notifications with minimal human intervention.

-

Policy Administration:

RPA automates transactional and administrative activities like credit control, tax, regulatory compliances, and accounting settlements in the policy administration processes like rating, quoting, binding, issuing, renewing, and endorsing.

-

Business and Process Analytics:

RPA gathers analytics by performing, tracking and monitoring tasks. These analytics can be used to improve customer experience and business performance and streamline business processes.

-

Usage of Legacy Application:

RPA bridges the gap between legacy applications and ERP or BPM solutions using UI automation. RPA smartly fits into the existing technological infrastructure or workflows.

-

Policy Cancellation:

Multiple document formats are the biggest hurdle in the policy cancellation process. It involves many transactional tasks like cancellation date tally, inception date, policy term, and so on. Here, with Automation in insurance, policy cancellation can be carried out in just one-third of the time. RPA can seamlessly switch through all the interactions and provide faster resolution to the customers.

-

Query Resolution:

RPA empowers insurers to respond faster with bots. By using a predefined set of rules and Natural Language Processing technology, RPA bots can easily interpret incoming calls and emails and resolve simple queries without human intervention.

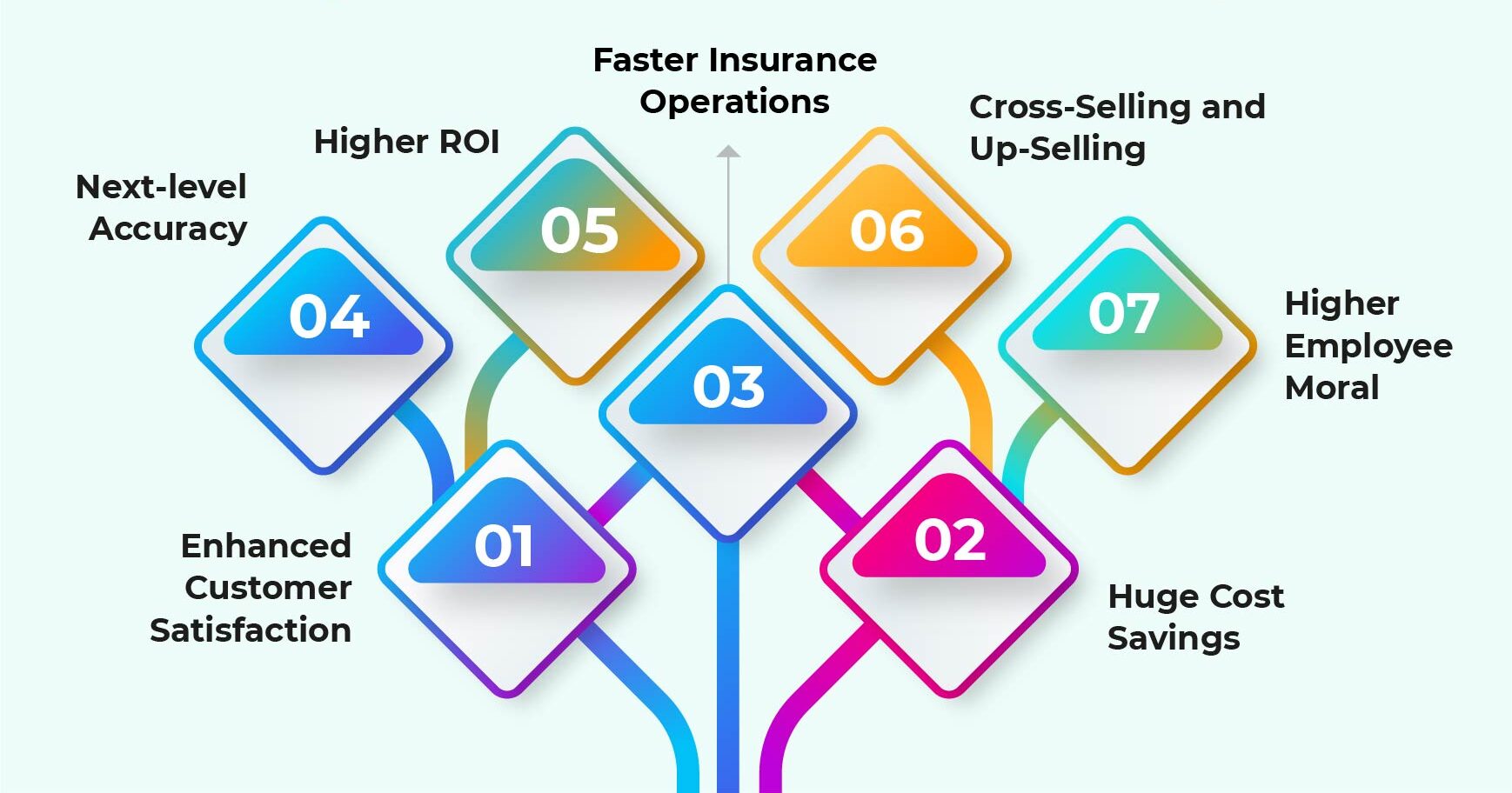

The Benefits of RPA in Insurance

RPA dramatically improves customer-facing as well as back-office operations. RPA in Insurance reaps the following benefits:

-

Enhanced Customer Satisfaction with RPA in Insurance:

Robotic Process Automation in Insurance significantly enhances customer satisfaction by streamlining data-intensive processes. For example, tasks such as onboarding new customers or processing policy cancellations, which traditionally required extensive paperwork and manual intervention, can now be automated. RPA bots swiftly navigate through multiple systems to process data, reducing delays and errors. This ensures a seamless customer experience, as claims or policy updates are handled faster and more accurately.

-

Huge Cost Savings through Insurance Automation with RPA:

RPA in Insurance optimizes business processes, leading to substantial cost savings. By automating repetitive tasks like claim verification and data reconciliation, insurers can reallocate human resources to more strategic roles. For instance, instead of spending hours on manual data entry, employees can focus on customer engagement or fraud detection. This shift not only reduces operational costs but also drives business growth by improving productivity.

-

Faster Insurance Operations with Robotic Process Automation:

Manual operations such as claim processing, eligibility verification, and Know Your Customer (KYC) checks often take hours or even days to complete. With RPA in Insurance, these tasks can be executed in minutes. For example, RPA bots can extract and validate claim data from multiple sources, ensuring faster claim settlements. This speed not only improves operational efficiency but also enhances customer trust and loyalty.

-

Next-Level Accuracy in Insurance Processes:

One of the standout benefits of Robotic Process Automation in Insurance is its ability to process vast amounts of data with unparalleled accuracy. Unlike manual processes prone to human error, RPA bots ensure data consistency and reliability. For instance, during underwriting or policy renewals, RPA can validate customer information against multiple databases, ensuring compliance and reducing the risk of errors.

-

Higher ROI with RPA-Integrated Legacy Systems:

RPA in Insurance extends the lifespan of legacy systems by integrating automation capabilities. This eliminates the need for costly system overhauls. For example, insurers can use RPA to automate policy generation or claims processing within their existing systems, achieving higher efficiency without significant infrastructure investments. This integration not only boosts ROI but also ensures smoother operations.

-

Cross-Selling and Up-Selling Opportunities:

Insurance Automation with RPA enables insurers to analyze customer data and identify patterns or preferences. For instance, RPA bots can track a customer’s policy history and suggest additional coverage options or complementary products. This personalized approach opens doors for cross-selling and up-selling, helping insurers meet dynamic customer needs while driving revenue growth.

-

Higher Employee Morale through Task Automation:

By automating repetitive and mundane tasks, RPA in Insurance allows employees to focus on more meaningful and value-added activities. For example, instead of spending hours on claim data entry, employees can work on resolving complex customer queries or developing innovative insurance products. This shift not only boosts employee satisfaction but also fosters a more motivated and engaged workforce.

Why RPA for Insurance Industry?

-

Cutting-edge technologies

have ensured the unparalleled success of RPA. Businesses have succeeded in performing end-to-end automation of laborious, voluminous, highly repetitive, multi-step tasks with multi-level validation and manual processes. RPA intelligently mimics a “virtual human” and has catapulted Artificial Intelligence and expert systems to the next level of competency.

-

Bots provide automation capabilities

for accomplishing routine and repeatable tasks. Artificial intelligence enables organizations to track processes and voluminous data to make intelligent decisions on the fly. In order to address complex challenges, Machine Learning algorithms and business logic are integrated to create intelligent automated business and IT processes.

-

RPA leverages the capabilities

of Deep Learning and Machine Learning by employing predictive models to work on big data. RPA is already on the path of cognitive automation, successfully solving problems just the way humans do, learning from experience, and making decisions based on that learning.

-

RPA propelled by these new-age technologies

has therefore succeeded in freeing humans from routine jobs and allowed them to focus on core functions. Success stories companies that have implemented RPA further add a feather to their cap, stamping their authority as one of the greatest technological innovations of the global industry.

How to Find the Best Software for Robotic Process Automation in Insurance Services?

With a large marketplace, it is struggling or challenging for insurance providers to get a perfect fit RPA solution that can help them in automating and streamlining the insurance process. Here are some key steps to follow and these are:

-

Define Your Requirements

The first step is to identify your specific needs and requirements for RPA in your insurance services. What processes do you want to automate? What are your performance goals? What is your budget? By defining your requirements upfront, you can narrow down your options and find a solution that meets your needs.

-

Research Available Options

Once you have defined your requirements, research the available RPA software solutions in the market. Look for vendors that specialize in insurance automation and have a proven track record of success. Consider factors such as ease of use, scalability, and integration capabilities.

-

Evaluate Features and Functionality

Evaluate the features and functionality of each solution to determine if they meet your requirements. Look for features such as data extraction, process automation, and analytics capabilities. Consider how easy it is to configure and manage the software.

-

Check Customer Reviews and References

Look for customer reviews and references to get an idea of how other insurance companies have implemented the RPA software and their experience with the vendor. This can help you assess the reliability and effectiveness of the solution.

-

Consider Vendor Support

Consider the level of support offered by the vendor, including technical support, training, and ongoing maintenance. Look for vendors that provide comprehensive support to ensure that the solution meets your needs and operates smoothly.

By following these steps, you can find the best RPA software solution for your insurance services, which can help you automate processes, reduce costs, and improve efficiency.

Conclusion

The future of RPA in insurance is transformative, driven by innovation and increasing adoption of automation. Insurers are leveraging Robotic Process Automation to streamline claims processing, underwriting, and customer service, enabling faster and more accurate operations. With advancements like AI integration, RPA will handle more complex processes, improving decision-making and personalization.

Additionally, Insurance Automation with RPA will enhance regulatory compliance and fraud detection. As technology evolves, RPA promises a future of efficiency, cost savings, and superior customer experiences in the insurance industry.

Frequently Asked Questions (FAQs)

The post RPA in Insurance: Benefits, Use Cases & Challenges 2025 appeared first on AutomationEdge.

This is a companion discussion topic for the original entry at https://automationedge.com/blogs/rpa-in-insurance/