Table of Contents

- Introduction

- Challenges in the Insurance Industry

- Key Benefits of Intelligent Automation in Insurance

- Transforming Insurance Processes with Intelligent Automation Services

- Agentic AI and Generative AI in Insurance

- AutomationEdge’s FinFlos: Revolutionizing Insurance Operations

- Way Forward for Automation in Insurance

- FAQs

Table of Contents

- Introduction

- Challenges in the Insurance Industry

- Key Benefits of Intelligent Automation in Insurance

- Transforming Insurance Processes with Intelligent Automation Services

- Agentic AI and Generative AI in Insurance

- AutomationEdge’s FinFlos: Revolutionizing Insurance Operations

- Way Forward for Automation in Insurance

- FAQs

Introduction

The insurance industry is at a pivotal moment. With increasing customer demands, evolving regulatory requirements, and growing competition, insurers are under immense pressure to streamline operations, improve efficiency, and deliver better customer experiences. However, traditional processes in the insurance sector are often manual, time-consuming, and prone to errors, which hinder growth and innovation.

This is where intelligent automation in insurance comes into play. By combining technologies like robotic process automation (RPA), artificial intelligence (AI), and Generative AI (Gen AI), insurers can revolutionize their operations and meet the challenges of the modern insurance landscape. AutomationEdge is leading the way, helping insurers harness the power of automation to streamline key processes and scale their operations effectively.

Challenges in the Insurance Industry

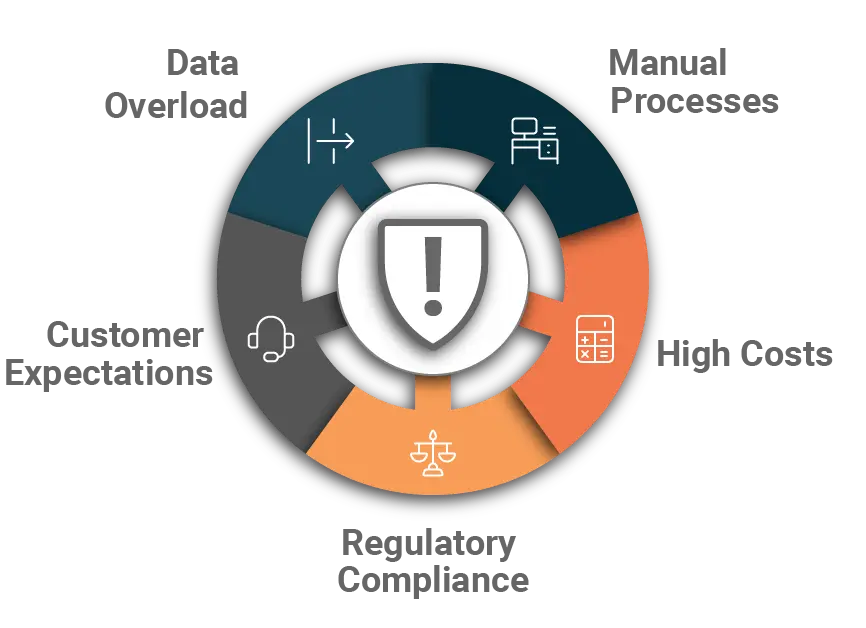

The insurance sector faces several challenges that hinder operational efficiency and customer satisfaction:

- Manual and Repetitive Processes: Processes like claims processing, underwriting, and policy issuance are often manual, resulting in delays and inefficiencies.

- High Operational Costs: Legacy systems and manual workflows increase operational costs, making it difficult for insurers to stay competitive.

- Regulatory Compliance: The industry is heavily regulated, requiring insurers to ensure compliance with various laws while managing large volumes of data.

- Customer Expectations: Customers now demand faster, more personalized services, challenging insurers to modernize their processes.

- Data Overload: Insurers deal with massive amounts of data from multiple sources, making it difficult to analyze and utilize effectively.

To address these challenges, insurers need more than just traditional technology solutions. They need scalable, adaptable solutions that automate processes, reduce costs, and improve service delivery. That’s where intelligent automation in insurance steps in.

Imagine a customer files an auto insurance claim after a minor accident. Traditionally, the process might take days or even weeks, involving multiple steps like document submission, verification, and approval.

With intelligent automation in insurance, here’s how the process transforms:

- The customer uploads photos of the damaged vehicle and fills out the claim form online.

- AI-powered automation instantly extracts and validates the information from the form and photos.

- The system uses machine learning to assess the damage and cross-checks the policy details for coverage.

- If the claim meets predefined criteria (e.g., low-risk claims), a robotic process automation (RPA) bot automatically approves the claim and triggers the payout.

- The customer is notified within minutes, and the payment is processed the same day.

This seamless process eliminates manual intervention, reduces errors, speeds up claim resolution, and enhances the customer experience through intelligent automation.

Key benefits of intelligent automation in insurance:

The integration of intelligent automation in insurance delivers several benefits for insurers:

-

Faster Claims Processing

Automating claims processes with robotic process automation in insurance reduces processing times significantly. RPA bots can extract, validate, and process claims data quickly, enabling faster payouts and improved customer satisfaction.

-

Improved Accuracy and Reduced Errors

Manual processes are prone to errors, especially when handling large volumes of data. Intelligent automation ensures accurate data entry, reducing errors in critical processes like underwriting and policy issuance.

-

Enhanced Customer Experience

Through automation, insurers can provide faster responses to customer inquiries, deliver personalized experiences, and reduce wait times, leading to increased customer loyalty.

-

Cost Reduction

Automating repetitive tasks reduces the need for manual intervention, lowering operational costs. Additionally, insurers can optimize resource allocation and focus on value-added activities.

-

Better Regulatory Compliance

Intelligent automation helps insurers stay compliant by automating the generation of reports, monitoring regulatory changes, and ensuring accurate record-keeping.

-

Data-Driven Decision Making

AI-driven insurance processes enable insurers to analyze large volumes of data in real time, gaining valuable insights to make informed decisions.By adopting intelligent automation, insurers can not only address existing challenges but also unlock new opportunities for growth and innovation.

Transforming Insurance Processes with Intelligent Automation Services

Most insurance companies are well into the process of going paperless, including the digitization of claims documents. However, these efforts often lack the intelligence that is available from a fully integrated automation solution—whether within the digitization process or later when the claims are being routed. With a modern, intelligent document automation solution that leverages next generation tools much of your preparation time, cost, and errors can be removed—delivering almost an immediate ROI. AI solutions can now optimize complex business processes by turning even handfilled paper documents—like insurance applications and claims—into business-ready data automatically.

Intelligent automation is revolutionizing key insurance processes, making them faster, more efficient, and customer-centric. Here’s how it is transforming the industry:

-

Claims Processing

Traditionally, claims processing involves multiple steps, from data collection and verification to final settlement. Automation simplifies this process by:

- Extracting claims data from emails, forms, and documents.

- Validating data against policy terms.

- Automating approvals for low-risk claims.

For example, RPA bots can process claims from submission to settlement, reducing turnaround times from weeks to hours.

-

Underwriting

Underwriting is a critical process in insurance, requiring detailed risk assessment. Intelligent automation enhances underwriting by:

- Analyzing historical data and market trends using AI.

- Automating risk scoring and decision-making.

- Reducing manual effort in data collection and analysis.

-

Policy Issuance and Renewals

Automation streamlines the policy issuance process by ensuring accurate data entry, auto-generating policies, and sending timely reminders for renewals. This reduces delays and improves policyholder satisfaction.

-

Fraud Detection

Fraud is a significant concern for insurers. Intelligent automation uses AI and machine learning to:

- Identify patterns of fraudulent behavior.

- Flag suspicious claims for further investigation.

- Minimize financial losses caused by fraud.

-

Customer Support

AI-powered chatbots are transforming customer interactions by providing 24/7 support. For example, chatbots can:

- Answer policy-related questions.

- Assist customers in filing claims.

- Provide real-time updates on claim statuses.

By automating these processes, insurers can focus on delivering value-added services and improving customer relationships.

Agentic AI and Generative AI in Insurance

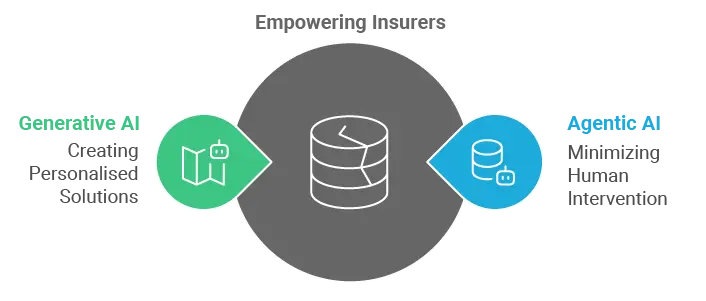

The insurance industry is increasingly leveraging Agentic AI and Generative AI to redefine how processes are managed.

Agentic AI refers to AI systems that act as virtual agents, capable of performing tasks with minimal human intervention. In insurance, Agentic AI powers:

- Virtual assistants for customer support.

- Automated risk assessments during underwriting.

- Smart assistants that guide brokers and agents in real-time.

Gen AI takes automation a step further by creating new content, such as:

- Generating personalized policy recommendations based on customer data.

- Creating tailored marketing campaigns to target specific customer segments.

- Drafting customer communication emails or reports automatically.

Example: Imagine an AI assistant that generates a personalized insurance policy summary for each customer, explaining complex terms in simple language. Gen AI makes this possible, enhancing customer understanding and engagement.

The combination of Agentic AI and Gen AI empowers insurers to deliver innovative, scalable solutions, ensuring they stay ahead in a competitive market.

AutomationEdge’s FinFlos: Revolutionizing Insurance Operations

AutomationEdge with FinFlos has been transforming insurance operations with its cutting-edge products and solutions. This comprehensive automation platform designed specifically for financial services and insurance industries.

Key Features of AutomationEdge’s FinFlos:

- End-to-End Process Automation: Automates critical processes like claims management, policy issuance, and underwriting.

- AI-Powered Capabilities: Integrates advanced AI and machine learning algorithms to enable smarter decision-making.

- Seamless Integration: Works seamlessly with legacy systems, ensuring minimal disruption during implementation.

- Scalability: Adapts to the growing needs of insurance companies, allowing them to scale their operations effortlessly.

- Compliance Assurance: Automates compliance monitoring and reporting, ensuring insurers meet regulatory requirements.

With FinFlos, AutomationEdge is enabling insurers to unlock the full potential of intelligent automation, driving efficiency and innovation across their operations.

Way Forward for Automation in Insurance

As technology continues to evolve, intelligent automation in insurance industry will play an increasingly critical role in driving innovation and growth. With automation and AI in insurance, insurers can harness the power of automation to streamline operations, enhance customer experience, and achieve their business objectives with ease. By embracing intelligent automations solutions, insurers can position themselves for success in an increasingly competitive and dynamic marketplace.

In conclusion, the scaling of intelligent automation in the insurance industry represents a significant opportunity for insurers to unlock new levels of efficiency, agility, and innovation. This shift towards AI in insurance is not just about staying competitive; it’s about redefining service delivery, the accuracy of risk assessments, and customer engagement. From streamlining operations to enhancing customer experience, automation and AI in insurance are revolutionizing operations and shaping the future of the industry.

Frequently Asked Questions (FAQs)

The post Scaling Intelligent Automation in the Insurance Industry appeared first on AutomationEdge.

This is a companion discussion topic for the original entry at https://automationedge.com/blogs/intelligent-automation-in-insurance/