Approximately 97% of the data handled by the insurance industry is unstructured, and the most valuable information lies within the adjuster’s notes, comprising unique words, acronyms, and abbreviations. Surprisingly, insurance firms utilize less than 3% of this data for decision-making, a revelation that highlights the untapped potential in this sector. Intelligent document processing (IDP) presents a solution to process unstructured data effectively, leading to improved customer satisfaction, operational efficiency, and overall business performance.

In the insurance domain, every step of the process heavily relies on documents, often in handwritten, PDF, or image formats. Human processing of these documents introduces the risk of errors, delays, and false assumptions, which can lead to significant issues. Intelligent document processing emerges as the optimal choice for handling sensitive documents, as it ensures better compliance and outcomes.

Before delving into how Intelligent document processing addresses bottlenecks in the insurance industry, it is crucial to understand the impact of Intelligent document processing by examining the conventional claim processing model in this sector.

Steps Involved in Insurance Claims Processing

The insurance industry comprises various types of insurance, each with its unique process flow. The standard claim processing procedure typically starts with policyholders reporting an event and submitting supporting documents to raise a claim request. Most of these documents are unstructured which makes the claims processing more complex. The steps involved in Claims processing are-

- Reporting – Once All the event-related documents are submitted, and the claim request is raises, an insurance agent is assigned to look into the claim. From here, all the process is done manually.

- Initiation of the investigation – Once the claim has been initiated, the insurance agent investigates and determines the claim amount.

- Policy review and evaluation – Following an investigation, insurers review policies, seek expert advice, and determine the extent of damage covered by insurance.

- Payment – Once a claim is initiated by the claim officer, the policyholder is notified.

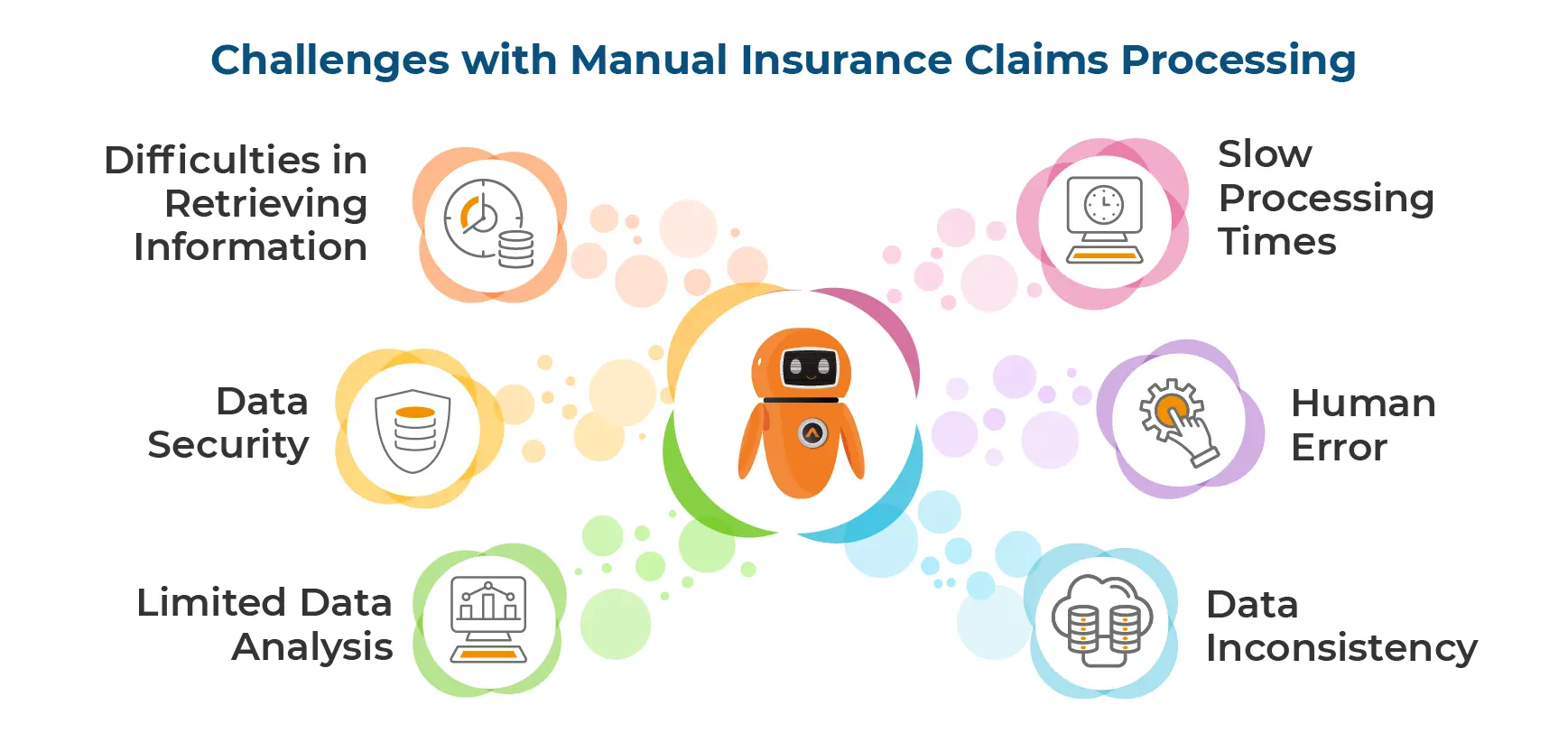

Challenges with Manual Insurance Claims Processing

According to the Accenture report, poor claims experience can put up to $170B of global insurance claims at risk. Some of the challenges that come with manual claims processing are-

-

Slow Processing Times

Manual claims processing involves the physical handling of documents, which can be time-consuming. It requires manual verification, data entry, and routing, leading to delays in claim approval and settlement.

-

Human Error

The reliance on human operators for data entry and processing increases the likelihood of errors. Even simple mistakes in data entry can lead to claim processing inaccuracies and delays.

-

Data Inconsistency

Manual data entry can lead to inconsistencies in how information is recorded and stored. This can cause difficulties in data retrieval and analysis, affecting decision-making and reporting.

-

Difficulties in Retrieving Information

Manually managed documents may not be easily searchable or retrievable. Finding specific information within a pile of physical documents can be time-consuming and frustrating.

-

Data Security

Physical handling of documents can pose security risks, including loss, theft, or unauthorized access to sensitive customer information. Protecting data privacy and security becomes more challenging with manual processes.

-

Limited Data Analysis

Manual processing hinders the ability to perform in-depth data analysis on claims trends and patterns. Analyzing data is crucial for identifying fraud, improving processes, and making data-driven decisions.

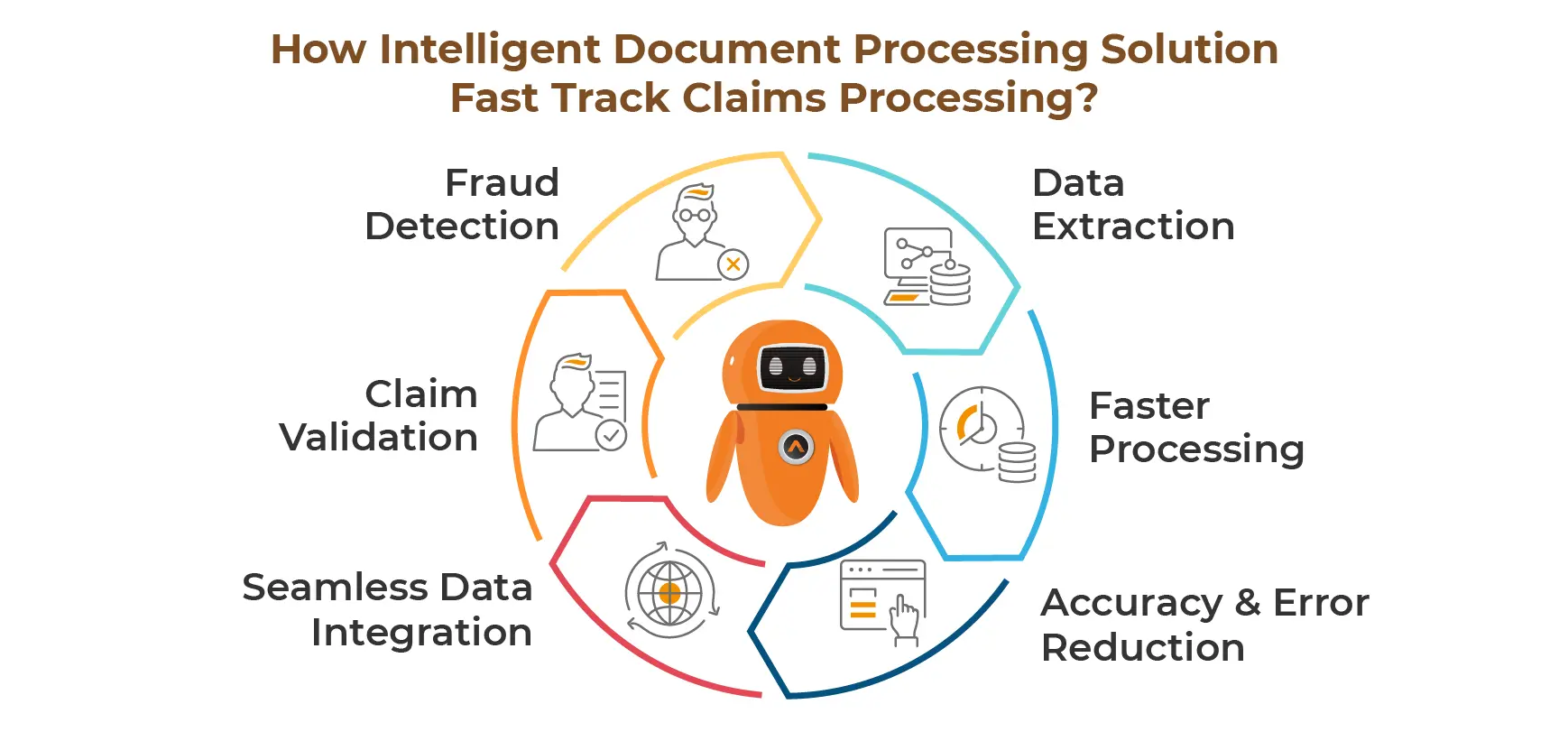

How Intelligent Document Processing Solution Fast Track Claims Processing?

Intelligent Document Processing (IDP) plays a significant role in streamlining and improving the efficiency of insurance claims processing. This solution combines technologies like Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML) to automate and optimize the handling of these documents.

Source Here’s how Intelligent Document Processing can help in insurance claims processing:

-

Data Extraction

Intelligent Document Processing can automatically extract relevant information from various types of documents, eliminating the need for manual data entry. This includes extracting policyholder details, claim amounts, incident descriptions, dates, and other critical data points required for processing the claim.

-

Faster Processing

With Intelligent Document Processing, the claims processing time is significantly reduced since manual data entry is eliminated. This leads to faster claim approvals or rejections, ultimately enhancing customer satisfaction and improving the overall claims handling time.

-

Accuracy and Error Reduction

Human involvement in data entry is prone to errors, but Intelligent Document Processing systems can achieve high accuracy rates in data extraction and analysis. By reducing human error, insurers can avoid costly mistakes that might lead to claim delays or incorrect payouts.

-

Fraud Detection

Intelligent Document Processing can be integrated with fraud detection algorithms to flag suspicious claims based on historical patterns and anomalies found in the data. This helps insurers identify potentially fraudulent claims early in the process and take appropriate actions.

-

Claim Validation

Intelligent Document Processing can cross-reference data extracted from various documents against existing policy information and other databases to validate the legitimacy of the claim. This ensures that only valid claims are processed, reducing the risk of payouts for fraudulent or ineligible claims.

-

Seamless Data Integration

Intelligent Document Processing solutions can be integrated into existing insurance claims systems, allowing for a seamless transition to automated document processing without the need for a complete overhaul of the existing infrastructure.

[Also Read: How Automated Claims Processing Accelerates the Customer Experience in Insurance Industry?]

How can AutomationEdge Help?

AutomationEdge DocEdge is an IDP tool, is designed to automate the extraction and processing of data from unstructured documents. It leverages technologies such as Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML) to intelligently recognize and extract information from various types of documents, such as invoices, purchase orders, insurance claims, bank statements, and more. Irrespective of industries, intelligent document processing can be used in banking, healthcare, insurance, and many others. To know more about how you can automate data extraction and processing across your enterprises, do contact us here.

The post How Intelligent Document Processing Helps in Insurance Claims Processing? appeared first on AutomationEdge.

This is a companion discussion topic for the original entry at https://automationedge.com/blogs/how-intelligent-document-processing-helps-in-insurance-claims-processing/