Despite all the trending technology adopted by insurance leaders to attract new customers, the claims process is still one of the most critical experiences a current policyholder has with an insurance provider. And this traditional method of claims processing is challenging due to the large volume of work in the hand of insurance providers like sifting through documents to check errors, assess risks, and make sure that claims payment is initiated on time, which needs to be done manually on time.

That’s how the claims processing often becomes a “tail wagging the dog” scenario as obtaining accurate and timely documents and information requires a considerable amount of organization time and effort. This can cause significant dissatisfaction among policyholders, who can easily take their business elsewhere.

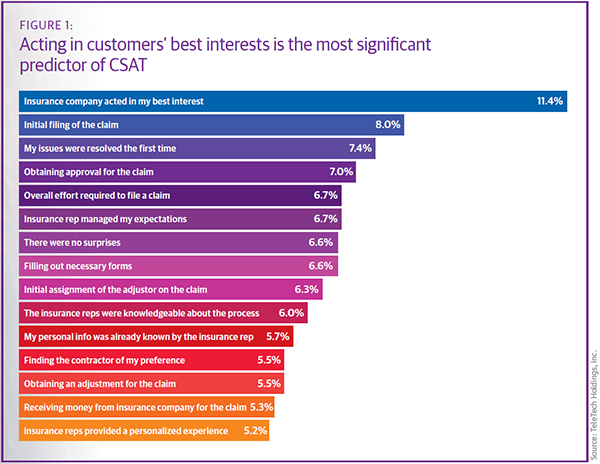

And we all know that a positive customer experience is all insurance leaders need to attract more customers and accelerate their ROI. According to a report, the average customer satisfaction level highly depends on the efficiency of the initial claims processing. The below image truly depicts the initial filling of claims and the competence of insurance agents.

So, how can insurance leaders accelerate claims processing and accelerate the customer satisfaction score? Is there any solution? Let’s find out the answer in this blog.

Challenges in Manual Claims Processing

Government regulations and penalties, coupled with a constantly growing volume of claims, exacerbate the status quo that many insurers face – like slower resolution times that frustrate customers and soaring operational costs caused by error-prone data handling. Let’s look at the challenges faced by insurers in brief-

-

Heavy Operational Cost

Keeping costs in check is always at the top of the list while modernizing traditional claims processing. When systems all across the organization are not integrated, the claims agent must have to look across multiple systems and sources to find the right information rather than apply his decision-making to settle the claims. Also, insurer agents also have to re-key the information between system or emails, CRM, and backend applications. This approach introduces errors, frustration, and additional costs.

A recent study found that only 5% of insurers are fully digitized or automated. -

Lack of Consistent Delivery

It is common for manual claims processing to lack consistency and efficiency in task management. A customer may be dissatisfied when an insurance agent calculates different payouts for identical claims. Furthermore, if one claim is given priority over another without proper time management, delays and inaccuracies can occur.

-

Poor Data Integration

In claims processing, data integration is the technical process of combining data derived from multiple sources and creating a centralized system. Additionally, the main concern with data is dealing with inaccurate and outdated data. A single error in the system leads to customer dissatisfaction and errors in initiating the claims payment that further leads to a dissatisfied customer experience.

According to a recent survey, only 30% of policyholders reported a positive experience with their insurance providers. -

Increasing Claims Fraud

As per the report, insurance claims fraud estimates loss is $308.6 billion in the year 2022. Such malicious claims add up to extra strain on insurance agents as a lot of time must be dedicated to analyzing the authenticity of claims. And if analyzed manually it takes a long time to check the authenticity and chances of errors as well. This is another reason that almost 78% of consumers are concerned about insurance fraud.

-

Rising Customer Expectations

When it comes to customers, convenience, and communication are at the top of the list. Also with rising online claims management insurers’ agents are expected to be available 24/7 to answer customer queries. And with more innovative players entering the market policy pricing and quality is not the only enough to retain customers.

How Automated Insurance Claims Processing Work?

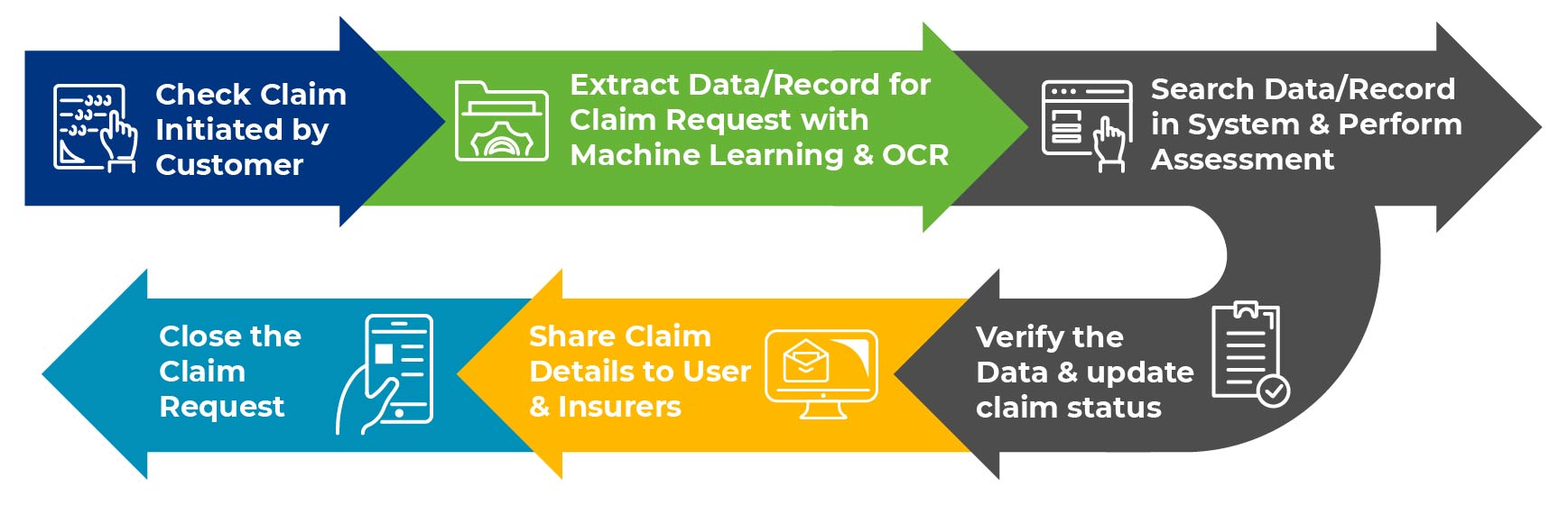

Claims processing involves a series of steps before claims payment is transferred to the customers. Using automation technologies like RPA in insurance claims processing a lot of tasks are involved in the claims process. Let’s see how automated claims processing work.

-

Data Entry

To initiate the claims process, insurers’ agents had to go through a lot of paper trails, emails and pdfs to extract data to check the claims information. Reporting and processing this whole data into a claims management system, requires a lot of focus and attention. In this process, using intelligent RPA bots can automate the data entry task and reduce the chances of errors and speed up the claims processing.

-

Claims Verification

As soon as the data is entered into the claims management system, insurers’ agents have to go through a thorough assessment of claims documents initiated by users. Insurers also have to make sure that every data that is collected are accurate, matches the regulatory compliance, and is not duplicated. RPA in insurance claims processing can cross-verify and check the claims data against relevant database and rules and determines the amount of compensation that is payable. Going automation way, insurance agents can potentially detect fraud and reduce the time required to process claims

-

Claims Adjudication

After claims verification, RPA can help insurance agents in determining the eligibility of claims by comparing them against the pre-determined rules set by insurers. AI-enabled RPA in insurance claims processing can easily flag claims that require attention and ensure that claims are adjudicated accurately and efficiently. Also, an RPA chatbot can help in appealing for claims in case claims are denied.

-

Claims Settlement and Communication

As soon as claims data is verified and settlement is done, insurance agents need to communicate with policyholders for sending out notifications and reminders. Here instead of humans sharing information, RPA bots can be leveraged to share information. This rules out the requirement of offering operational availability 24/7 for claims processing and reduces the workload for humans.

Benefits of Automated Claims Processing

Automated claims processing can bring several benefits to insurance companies, including

-

Increased Efficiency

Automated claims processing can reduce the time and effort required to process claims. This means that claims processing is done more quickly, and resources can be allocated more efficiently.

-

Reduced Errors

Using intelligent RPA bots can minimize the risk of errors and omissions. This can help to ensure that claims are processed accurately and that claimants receive the appropriate compensation.

-

Cost Savings

Having RPA bots take care of the data reporting and verification tasks can reduce the cost of claims processing. As cost is reduced, insurance agents can better use the money for implementing RPA solutions in other insurance processes.

-

Improved Customer Experience

Automated claims processing can improve the customer experience by reducing processing times and providing faster and more accurate claims decisions. This can help to increase customer satisfaction scores and make sure these customers stay longer with your organization.

-

Better Data Management

Using intelligent document processing bots can help to improve data management by capturing and storing data in a more structured and organized manner. This can make it easier to analyze data and identify patterns that can be used to improve claims processing.

-

Fraud Detection

Automated claims processing can also help to detect fraudulent claims by using machine learning and artificial intelligence to identify anomalies and inconsistencies in claims data.

Conclusion

As customer needs change rapidly and competition increases, insurers continue to face challenges. Furthermore, insurers have begun implementing RPA in back-office processes to automate transactional, routine, rule-based tasks during which capital and talent are repurposed to address more complex and strategic challenges. Using robotic process automation in insurance can promote long-term success and productive market opportunities. Due to its versatility and advantages, automation will undoubtedly be adopted in the insurance sector as well.

The post How Automated Claims Processing Accelerates the Customer Experience in Insurance Industry? appeared first on AutomationEdge.

This is a companion discussion topic for the original entry at https://automationedge.com/blogs/how-automated-claims-processing-accelerates-the-customer-experience-in-insurance-industry/